Meta Description: A beginner’s guide to investing 2025. Here’s How to Get Started With Investing 2025 Challenge Yourself To Start Investing Today

2025: The Year to Start Investing – Introduction:

Investing can seem intimidating when you’re starting out. But 2025 might be the best year for first-timers to wade into investments. And as the broader financial landscape shifts, there are more ways than ever for you to build wealth for your future, whether that means saving for retirement, purchasing a home, or creating a financial cushion.

In this beginners guide, well demystify all you need to know to get started in investing in 2025. It could be stocks if you are in the stocks BUSSES or funds, we’embroiled in you. Let’s dive in!. Why You Should Start Investing in 2025?

Investing in 2025 could be an anchor to long-term wealth. Here’s why:

1. Lower Interest Rates: If you still hang on the conventional saving methods, it would be less effective, given that saving accounts still offer comparatively lower interest rates. Investing can give you more gains over the long term.

2. Stock Market – Long-Term Growth: The stock market, even though it fluctuates, has always delivered growth on a long-term basis. Now is an excellent time to get started as new technologies are developed and world markets expand.

3. Inflation: Investing keeps you one step ahead of inflation. Cash that sits in a bank account depreciates over time, while investments can do better than inflation.

4. Retirement Savings: The sooner you start, the longer your investments can grow. A head start toward retiring comfortably starts now.

Understanding the Basics of investing:

Before you begin investing, though, it helps to understand the basics. Here’s a guide to important investment terminology and choices:

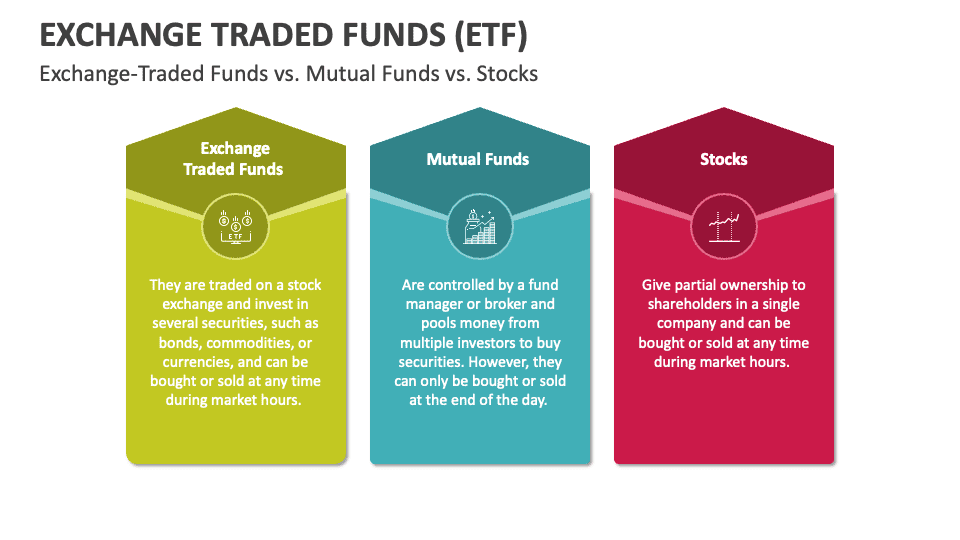

- Stocks: When you own a stock, you own a piece of a company. Your investment increases when the company does well.

- Bonds: Bonds represent loans you make to companies or governments. In exchange, they pay you interest.

- Mutual Funds: A professionally managed collection of stocks and bonds. They provide diversification, which is to say that your investment is spread out over many assets.

- ETFs: These exchange-traded funds are like mutual funds but can be traded like stocks, offering greater flexibility and often lower fees.

Types of Investments for Beginners in 2025:

When you are just starting, you shouldn’t be buying it all. Begin with a list of options consistent with your objectives and risk posture. Some of the best types of investment for beginners include:

1.Stocks:

While investing in individual stocks can be exhilarating, it does carry a higher level of risk. If you’re new to investing, think about blue-chip stocks — shares of strong established companies like Apple, Microsoft or Amazon.

2.Mutual Funds & ETFs:

Mutual funds and ETFs are excellent alternatives. They provide diversification, so they make you a bit less risky. One investment lets you own thousands of stocks and bonds.

3.Real Estate:

Though real estate seems a distant dream, you can invest in property through REITs (Real Estate Investment Trusts) without owning any.

4.Cryptocurrency:

While volatile, cryptocurrencies such as Bitcoin and Ethereum are becoming increasingly mainstream. If you are open to taking a bit of risk, think about putting a tiny percentage of your investment portfolio in here.

5.Robo-Advisors:

If you don’t have time or are not skillful enough, robo advisors are a great option as these automated services will build and manage an appropriately priced investment portfolio for you.

How To Choose The Right Investment For You:

Usually, you will focus on this criteria when selecting an investment:

1.Risk Tolerance:

Are you willing to take short-term losses so that there is a higher return in the long run? If your answer is a yes, you can look into stocks. For those who would like more of a cushion, bonds and mutual funds are suitable.

2.Investment Horizon:

The further out you are from retirement (which is many years in the future), the more investment risk you can afford to take. That said, if your savings goal is within the next 1 to 3 years, then the investments need to be conservative.

3.Financial Goals:

Outline your goals. Is it a long-awaited vacation, or perhaps a house, or funding retirement? The goals will dictate the appropriate investment approach tailored for you.

Step-by-Step Guide: How to Start Investing in 2025:

Scheduled to begin? Check out this straightforward, incremental approach to starting investments in the year 2025:

1.Create Fund Management Strategies.

Identify the purpose of your investing efforts, e.g., retirement, home purchase, or wealth increase.

2.Start an Emergency Fund

An emergency fund is a financial safety net that can cover 3-6 months of living expenses. Ensure you have this squared away before you start investing.

3.Open an Investment Account

Starting with a brokerage account or an investment app account is a good idea. Robinhood, Fidelity, and Wealthfront are examples of platforms that cater to beginners.

4.Start Small

Don’t be afraid to start with a small investment. Whether it Whether it is 50or500, the key is always starting, and contributing further over time.

5.Consistency Is Key

Set up automatic deposits, whether on a weekly, bi-weekly, or monthly basis. Growing your wealth takes consistency over time.

Table of Contents

Common Mistakes to avoid as a Beginner Investor:

While investing can be fun and entertaining, there are some major mistakes that can be made. here are some things to look out for:

1.Chasing Quick Gains:

Obtaining high returns too quickly is terribly tempting, however risky. Picking funds with established track records of steady growth provides more stability and are a less stressful means of growth. Avoid high risk investments based on enticing returns. Focus on considerably growing them.

2.Neglecting Diversification:

Risk gets an exacerbating boost as a consequence of ample allocation towards a stock or a single investment type. Make an effort to shift your put money in portfolios and funds that contain stock market equities, bonds, and various other classed investment types

.

3.Ignoring Fees:

Be on the lookout for high fees associated with some investments as they may significantly impact the income you receive in the end. Focus on low fee options such as index funds or ETFs which allow for the enhancement of assets. Over time it gives you a greater return.

Tips for Successful Long-Term Investing:

1.Start Early:

The sooner you start, the longer your investments have to increase in value. Remember that compound interest is beneficial to you.

2.Reinvest Your Dividends:

long-term growth is enhanced by cashing out dividends and reinvesting them to buy additional shares.

3.Review Your Portfolio Regularly:

Changes in life should be mirrored by changes to your portfolio. Your investments should be re-evaluated at a minimum frequency of once every calendar year.

Conclusion: Start Investing in 2025 and Secure Your Financial Future

- A person willing to build wealth and secure their financial future will find investing in 2025 to be a prudent decision. With the proper knowledge, tools, and strategy, anyone, irrespective of experience, can access the investment world and make their money work for them.

- So were you waiting for a sign to proceed? Start today and create a clear long term investment strategy and stay consistent. Thank yourself in the future!..fidelity goal booster““fidelity goal booster”

Please don’t forget to share this guide with others who may benefit from it if you found this guide useful for your purposes. For more tips on investing and creating wealth, follow us!

FAQs

What is the best way to start investing in 2025?

Start with low-cost, diversified options like index funds, ETFs, or robo-advisors. Consider opening a retirement account (401(k) or IRA) and explore fractional shares to invest with less money.

Is it too late to start investing in 2025?

No, it’s never too late! The earlier you start, the more your money can grow, but even starting later can still help you build wealth over time.

How much money do I need to start investing as a beginner?

You can start with as little as $5 to $10 for stocks or ETFs. Robo-advisors may require $500 or less, and retirement accounts often start with $100 to $500 per month. The key is to start with what you can afford.

Nice idea